The potassium humate shiny flakes market is experiencing steady growth, driven by increasing demand for sustainable and organic farming practices. Below is a concise overview based on current trends and projections:

Market Overview

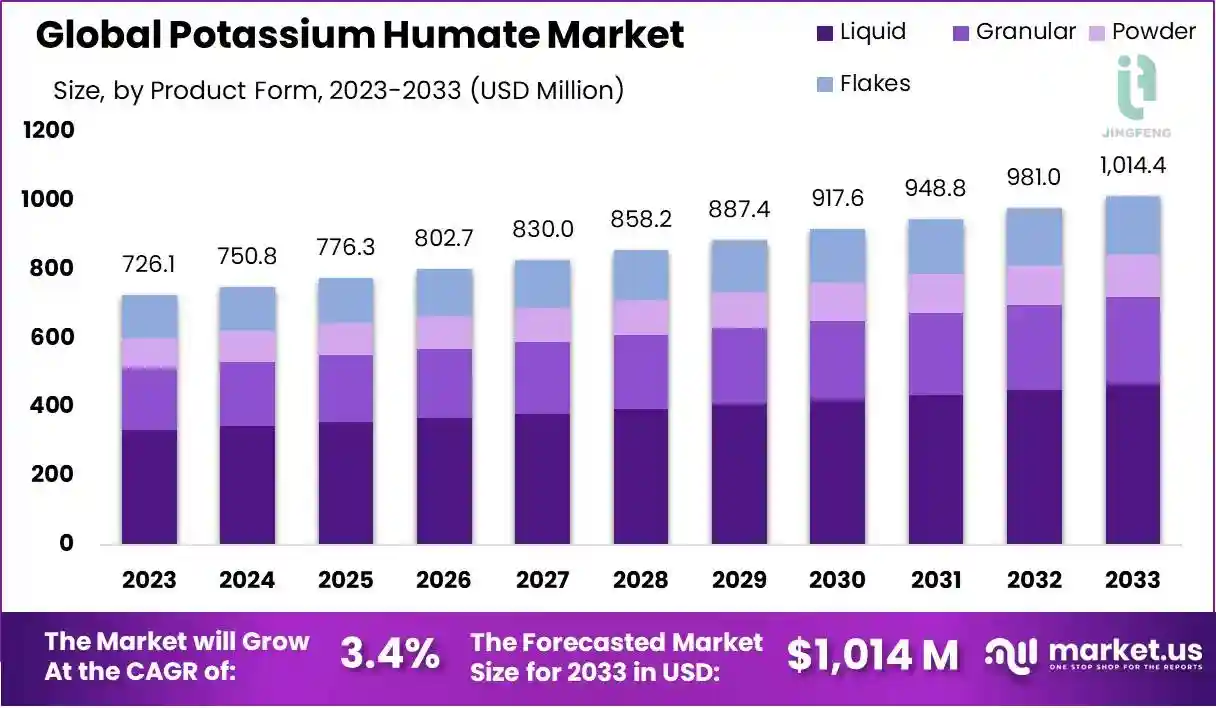

- Market Size and Growth: The global potassium humate market was valued at approximately USD 727.91 million in 2024 and is projected to reach USD 1.08 billion by 2037, growing at a CAGR of around 3.1% during 2025–2037.

- Key Drivers:

– Sustainable Agriculture: Rising awareness of the negative impacts of chemical fertilizers (e.g., soil degradation, water pollution) is boosting demand for eco-friendly alternatives like potassium humate, which enhances soil fertility and nutrient uptake.

– Organic Farming: The global shift toward organic food production, particularly in regions like Asia-Pacific, Europe, and North America, is increasing the use of potassium humate as a natural soil conditioner.

– Population Growth: A growing global population and shrinking agricultural land are driving the need for higher crop yields, with potassium humate improving soil health and productivity.

- Applications: Potassium humate shiny flakes are primarily used in agriculture as soil conditioners and fertilizers, promoting root development, nutrient uptake, and stress tolerance in crops. They are also applied in horticulture, livestock feed additives, and niche areas like water treatment and animal feed.

Regional Insights

- Asia-Pacific: Expected to dominate with a 36% revenue share by 2037, led by China and India due to large agricultural sectors and increasing organic farming adoption.

Key Potassium Humate Market Insights Summary:

Regional Highlights:

Asia Pacific potassium humate market will secure over 36% share by 2035, driven by the region catering to global demand for agricultural products.

North America market will account for 27% share by 2035, driven by extensive use of soil conditioners and eco-conscious farming practices.

Segment Insights:

The soil conditioners segment in the potassium humate market is expected to achieve a 46% share by 2035, driven by increasing awareness of soil health, sustainability, and government policies.

The powder segment in the potassium humate market is forecasted to hold a 44% share by 2035, driven by ease of use, longer shelf life and cost-effectiveness in agricultural applications.

Key Growth Trends:

Growing Development of the Organic Food Industry

Growing Technological Advancements in Bio-stimulant Production

Major Challenges:

Inconsistent Quality of End-Products

High Costs Compared to Other Fertilizers may Hinder Market Growth

Key Players: ICL, Locus AG, BASF AG, Solvay SA, UPL India, Syngenta, Croda international PLC, Bayer Crop Science, Eastman chemical Company, Evonik Industries AG.

- Europe: Strong growth driven by sustainability initiatives and organic fertilizer demand, with companies like Bayer launching new potassium humate-based products.

Recent Development

In March 2024, BASF AG announced the expansion of its humic substance product line focusing on eco-friendly fertilizers, including Potassium Humate. The company invested€30 million in a new production facility in Europe to enhance its capacity for sustainable fertilizers. This investment aligns with BASF’s strategy to increase its organic farming product portfolio by 15% over the next three years.

In May 2024, Bayer Crop Science launched a new Potassium Humate-based organic fertilizer targeted at the European market. The company reported that the new productline is expected to generate €50 million in revenue by the end of 2025. The launch is partof Bayer’s plan to capture 20% of the organic fertilizer market in Europe by 2027.

In July 2024, Evonik industries announced an investment of $40 million to expand itsPotassium Humate production capacity in North America. The investment will increaseproduction by 25% by the end of 2024, aimed at meeting the rising demand for organicfertilizers in the region. Evonik expects this move to contribute an additional $15 million inrevenue by 2025.

- North America: Expansion in production capacity (e.g., Evonik’s $40 million investment) reflects rising demand for organic fertilizers.

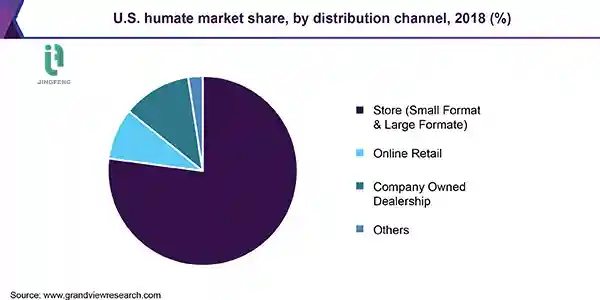

The U.S. humate market size was estimated at USD 139.9 million in 2018 and is expected to expand at a CAGR of 10.7% over the forecast period. The growing popularity of organic farming in the country is expected to drive growth. Organic farming, which makes up a small part of the overall agriculture in the U.S., has been witnessing more than 50% rise on a year-on-year basis. The country is home to more than 5 million organic farmers. California, Wisconsin, and New York are some of the major states witnessing high adoption of organic farming. The rise in federal spending on agriculture and easy approval for organic products has promoted organic farming in the U.S.

Horticulture and agriculture are the major application areas for humate. The availability of several humate-containing products in the plant nutrition category is expected to augment market growth in the near future. Potassium humate is the most widely used humate derivative in the U.S. and is commonly used with urea, Diammonium Phosphate (DAP), Monoammonium Phosphate (MAP), and Monopotassium Phosphate (MKP).

Humate is in the introductory phase of the product lifecycle in the U.S. However, the product is expected to witness increased adoption in the forthcoming years due to the rise in new farming systems and the proliferation of substitutes to conventional inorganic fertilizers. Rising awareness about the benefits of the product is expected to promote its utilization in the country.

The overuse of synthetic agrochemicals causes health and environmental hazards, which is likely to fuel the utilization of humate in the forthcoming years. Moreover, stringent regulations by the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) on the use of synthetic fertilizers is expected to further fuel the demand. The humate formulations are made up of necessary polyphenol, hormones, ketones, natural sterols, and fatty acids, making them highly efficient.

However, the organic products available in the U.S. as well as the global market lack consistency and standardization which can result in the usage of inappropriate ingredients. The U.S. government thus needs to focus on standardizing organic products. Some products have been listed under its National Organic Program, which offers certifications and labeling on the presence of organic content. Humate is yet to be considered under this program, which restraints its growth in the country.

Product Trends

- Potassium humate Shiny Flakes: These are valued for their high solubility (often 98–100% water-soluble), ease of application (foliar spray, drip irrigation), and high potassium content (8–12% K₂O). They contain humic and fulvic acids, enhancing soil structure and nutrient retention.

- Market Segmentation: Flakes are one of several forms (granular, powder, liquid), with granular and powder dominating due to versatility, but flakes are gaining traction in niche applications like fertigation and foliar sprays.

The Potassium Humate shiny flakes Market is currently experiencing a notable transformation, driven by increasing awareness of sustainable agricultural practices and the rising demand for organic fertilizers. This shift is largely attributed to the growing emphasis on enhancing soil health and improving crop yields without resorting to synthetic chemicals. As farmers and agricultural stakeholders seek environmentally friendly alternatives, potassium humate emerges as a viable solution, offering benefits such as improved nutrient absorption and enhanced microbial activity in the soil. Furthermore, the versatility of potassium humate in various applications, including horticulture, turf management, and soil remediation, contributes to its expanding footprint in the market. In addition to agricultural applications, the Potassium Humate Market is witnessing interest from the industrial sector, where it is utilized in water treatment and as a soil conditioner. The increasing focus on sustainable practices across industries is likely to bolster demand for potassium humate, as companies strive to reduce their environmental impact. Moreover, ongoing research and development efforts aimed at optimizing the formulation and application methods of potassium humate may further enhance its market appeal. Overall, the Potassium Humate Market appears poised for growth, driven by a confluence of agricultural innovation and industrial sustainability initiatives.

Sustainable Agriculture Adoption

The trend towards sustainable agriculture is gaining momentum, as farmers increasingly recognize the importance of eco-friendly practices. Potassium humate plays a crucial role in this shift, providing a natural alternative to chemical fertilizers. Its ability to enhance soil structure and promote healthy plant growth aligns with the goals of sustainable farming.

Industrial Utilization

Beyond agriculture, potassium humate is finding applications in various industrial sectors. Its use in water treatment processes and as a soil conditioner highlights its versatility. This trend suggests a growing recognition of potassium humate’s benefits in enhancing environmental sustainability across different industries.

Research and Development Initiatives

Ongoing research efforts focused on potassium humate are likely to yield innovative formulations and application techniques. These initiatives may enhance the effectiveness of potassium humate, making it more appealing to a broader range of users. As new findings emerge, the market could see an influx of advanced products that cater to specific agricultural and industrial needs.

“The increasing adoption of potassium humate in sustainable agriculture practices appears to enhance soil health and crop productivity, indicating a shift towards eco-friendly farming solutions.

U.S. Department of Agriculture (USDA)”

Competitive Landscape

- Key Players: Include ICL, BASF AG, UPL India, Bayer Crop Science, Humic Growth Solutions, and others, focusing on R&D and production expansion to meet demand.

- Innovations: Companies are developing high-concentration, water-soluble formulations and exploring integrated soil fertility management systems.

APAC Market Insights

Asia Pacific industry is estimated to dominate majority revenue share of 36% by 2035. The region caters to global demand for agricultural products and is counted as one of the leading regions in producing many agricultural products like cotton, jute, pulses, spices, wheat sugarcane, and various other agricultural based products. For instance, India, with around USD 2.1 billion of wheat exports in 2022, is the largest wheat exporter in the Asia Pacific region. Also, the demand for potassium humate is growing rapidly. The demand for food products in the region is enormous as a result of this huge population. As a result of the leniency ranted by government regulations towards production and shifting consumer base to eco-friendly and organic products, many Chinese manufacturers are prioritizing expansion in China.

North American Market Insights

North American potassium humate markets expected to hold a share of 27%. during the forecast period. This is mainly due to its well-known agricultural sector extensive use of soil conditioners such as potassium humate, and a strong emphasis on environmentally responsible farming practices. Demand for potassium humate is growing due to concerns about soil health and adverse effects on the environment of agrcultural operations. Also, growing awareness about the benefits of potassium humate in improving solid fertility, enhancing nutrient uptake, and promoting plant growth.

Challenges

- Awareness: Limited farmer awareness of potassium humate benefits, particularly in developing regions, hinders adoption.

- Cost: Higher costs compared to synthetic fertilizers can be a barrier, though long-term soil health benefits offset this.

Outlook

The potassium humate shiny flakes market is poised for growth through 2037, fueled by organic farming trends, technological advancements in biostimulant production, and increasing demand in emerging markets. Investments in production and awareness campaigns will likely accelerate adoption, particularly in Asia-Pacific and Europe.

WRITTEN BY JFHA-YYX